Internal Audit Preparation Webinar – Recording and Summary

Internal Audit Preparation Webinar – Recording and Summary

In this one-hour internal audit preparation webinar, Brian Kellerman, Co-Founder & Chief Quality and Food Safety Officer at Kellerman Consulting explains how to perform internal audits correctly to satisfy the requirements for food safety & quality assurance certifications.

Requirements for Internal Audits

What is required for an internal audit?

Complete the internal audit at least annually, or more frequently depending upon the internal audit requirements for the certification that your company holds or is wishing to obtain. An internal audit cannot be properly performed without the following:

- We must select the standard to audit against

- We need enough time and the full attention of those being audited

- We must have a written record of the audit

Internally Auditing to a Standard

If you are desiring for your facility to obtain a specific food safety or quality management certification, internal auditing is a requirement to pass your certification audit. Prepare for your internal audit by downloading the standards of the certification scheme that you have selected for your audit.

- For Global Food Safety Initiative (GFSI) schemes, the SQF, BRCGS, and PrimusGFS codes are available for free download. The ISO 22000 codes and ISO:2015 codes are available for a fee.

- For GMP, GDP, and other certification audits, contact the certifying body that you plan on using to conduct your audit and they will supply the rules and expectations that you can download and use for your internal audit.

Filling out the Internal Audit Report

It is best practice to have the person who is completing the internal audit to avoid auditing their own work. Identify who in your organization who will be responsible for completing the internal audit and then create a spreadsheet prior to your internal audit with the following:

- A column that contains the rules for the certification scheme that you plan to be audited against and rows for each clause of the code for the certification scheme.

- Create a column for “Conformance” and provide options in the rows so the internal auditor can select “YES”, “NO”, or “N/A”.

- Create an “Evidence” column. You must document both conformance and non-conformances. (One tends to remember to document non-conformances, but auditors also want evidence of conformance).

- Add a column for the date and person completing the corrective action. All non-conformances must have documented corrective actions. In our example we write the corrective action in the row of the specific clause where we observed the non-conformance.

- Finally, add a column for Observations/comments, which can further explain findings.

Non-Conformances & Corrective Action with Internal Audits

After the internal audit it is important to address the non-conformances as soon as possible. You don’t want to wait months and then forget to check that the corrective actions were completed and that the problems were fixed and stayed fixed.

- There should always be non-conformances during internal audits

- Every non-conformance must have a correction and a corrective action

- Every non-conformance and its correction/corrective action should be presented at a management meeting

Internal Audits & Management Commitment

- Internal Audit results are presented to management each time they are performed

- If you don’t report the results, your internal audit was not done correctly

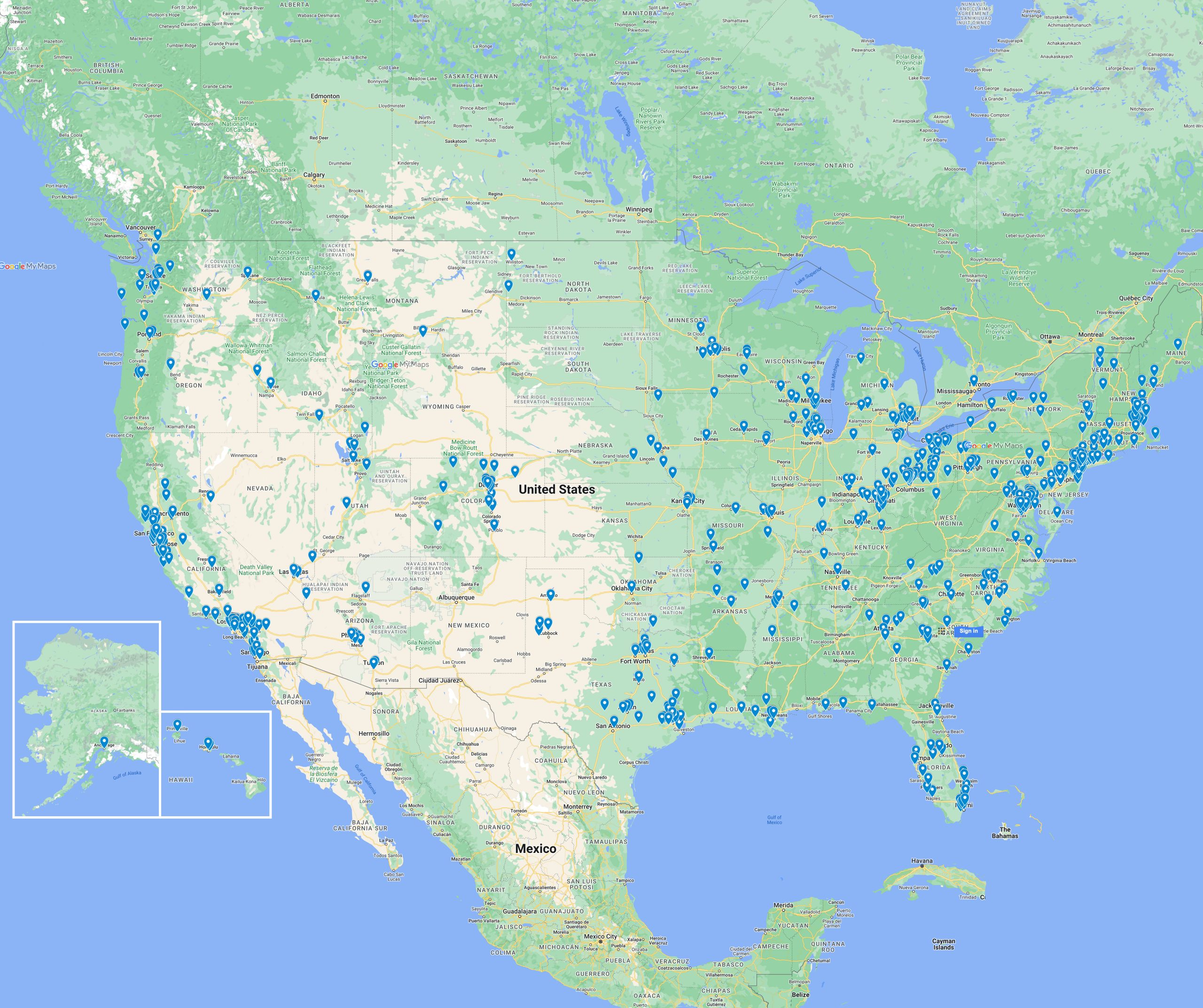

Supplier Audits

Off site audits are an excellent tool for strengthening the supplier approval program.

- Can be used for suppliers not capable of providing detailed or timely documentation

- Can be used as a corrective action for supplier non-conformance

- Demonstrates commitment to safety and quality.

Internal Audit vs. Supplier Audits

Travel Cost and Time Considerations

- With internal audits you don’t have to consider travel expenses if the employee completing the internal audit lives close to the facility.

- With supplier audits, travel cost and time can be a major issue.

Auditing Your Own Work

- With internal auditing, the biggest challenge is being able to not audit your own work.

- With supplier audits there is no risk of auditing one’s own work.

Non-Conformance Follow Up and Management Oversight

- With internal auditing, non-conformance follow up and management oversight is a modest challenge.

- With supplier audits, non-conformance follow up and management oversight is a major challenge.

Internal Audit Software

- Software for internal audits is nice to have, but it isn’t crucial. Software can be helpful for the uploading of evidence for corrective actions.

- Internal audits can be conducted with simple spreadsheets, which does not require special software.

Do you have additional questions about meeting internal audit requirements? Contact us for a free consultation.